Do Brokers Trade Against You?

Do brokers trade against you?

This is one of the common questions that new traders tend to ask all over the internet. While it might seem unlikely, the truth is that some brokers do trade against their own clients. So, let's see what is there to know about if brokers trade against you, and what impact it can have on your trading?.

Two broker categoriesAs mentioned, brokers do trade against their clients, which is not exactly a secret — nor is it actual cheating — but it is something that a lot of people may not even be aware of.

Another thing to note is that not all brokers do everything in the same way. In other words, details on how they operate differently from one broker to another, but most can be classified in one of two groups — A Book brokers and B book brokers.

When trading CFDsand Forexthe contract is always between you and the broker. So technically the broker is always trading against you. It is how they manage this risk themselves that makes the difference.

1) A Book brokersWhen it comes to A Book brokers, they are trading against their clients, but only in a technical sense. In other words, they do take the opposite side of the trade, but they tend to take a risk-neutral approach to the market. Their goal is to offset the trade as soon as possible,

Clients that are treated in this way are usually considered profitable, and no one wants to trade against profitable traders.

2) B Book brokersWhen it comes to B Book brokers, they will be a bit pickier when it comes to choosing what position of their own clients they want to offset. In other words, they might take a directional position and may actively trade against their clients.

With the majority of the clients (75%) losing in their trading, it is quite clear that the stats favour the brokers.

If you are new and you don't want to lose all of your money in a few months, at best, you will need to keep in mind some things about your brokers, especially when it comes to how to choose the right one to work with.

Whether a broker trades against the client is not the key question as long as they provide you with fair and clean execution of orders. There are numerous things to look for, but we will now list some of the most important ones. Always remember to check them out, as the success of your trades may very well depend on this.

1) Is your broker licensed and regulated?The first thing you want to check before even starting your cooperation with the broker is whether they are licensed and regulated. You have to understand that there are all kinds of dangers out there, especially when it comes to money.

Scammers will try to scam you, other traders will try to outsmart you, and everyone will try to use you for their own gain. This is why you need to look after yourself, which means securing your money.

The best way to ensure that you and your funds will remain safe and secure is to use a licensed service that is fully regulated. That way, you will have some confirmation that neither you nor your broker will get in trouble from the legal point of view, while everything that your broker offers will be in compliance with regulations, which are ultimately created to protect you, the client.

2) TrustworthinessOnce again, when you work with money, there is never enough trust. Unfortunately, you need to be able to trust others in order to be a trader, and that means trusting that they will keep your money secure and that they will keep their end of the bargain, which basically comes down to providing a good-quality service.

This is why you need to know all you can about your broker before you start dealing with them. That means researching their privacy policy, terms of service, reading up about who they are, what kind of people they employ, and most importantly — their other clients' reviews.

People have gotten rather bold online, and there is not a lot that they won't say if they are not satisfied with a service. That is what you need to use to your advantage, and read up on others' experiences and thoughts about the broker. These reviews will tell you what to expect, what are some positives and negatives about the broker. Most of all, reviews will help you decide whether a broker is trustworthy or not.

3) Ask questionsOne thing that people rarely do anymore is to ask questions directly to the service. For whatever reason, people tend to avoid direct communication and potential confrontation, and instead, they go and gather information 'from around' instead of going to the source.

This is the wrong way to approach things, and you should simply ask the broker directly about anything you wish to know. Licensed brokers must provide you with accurate and full information when you ask a question. They must follow detailed regulations that cover disclosure and fair trading. The most important information that you need is about their dealing desk policy. Brokers that operate outside regulations such as those without a license or registered in offshore tax havens may not tell you the truth, so as we said earlier make sure you deal with a licensed broker.

They might feel uncomfortable about admitting that they act as counterparties to your own trade, but they will still have to admit it and inform you about it.

4) Educate yourself热门曲谱

渡情笛子曲谱

渡情笛子曲谱 曲谱自学网今天精心准备的曲谱是《渡情笛子曲谱》,下面是详解!

竹笛 我想学 渡情 请问是买A还是B调 的笛子 我还要...

竹笛的调和...

[详情]分类:曲谱大全时间:07:36 c调口琴曲谱

c调口琴曲谱 曲谱自学网今天精心准备的曲谱是《c调口琴曲谱》,下面是详解!

求c调24孔口琴简谱大全

小弟求c调24孔口琴简谱大全,邮箱:zifuchen@st...

[详情]分类:曲谱大全时间:07:36 徳德玛歌曲谱

徳德玛歌曲谱 曲谱自学网今天精心准备的曲谱是《徳德玛歌曲谱》,下面是详解!

德德玛歌曲

1. 草原母亲河

[详情]分类:曲谱大全时间:07:36

2. 蓝蓝的马莲花

3. 阿妈的... 京剧青衣曲谱

京剧青衣曲谱 曲谱自学网今天精心准备的曲谱是《京剧青衣曲谱》,下面是详解!

京剧老旦唱段曲谱 与琴谱有什么区别

两者均属旦行。旦行包括:青...

[详情]分类:曲谱大全时间:07:35 诺言钢琴曲谱

诺言钢琴曲谱 曲谱自学网今天精心准备的曲谱是《诺言钢琴曲谱》,下面是详解!

洛洛历险记的片尾曲诺言的钢琴简谱(最好有前奏)

偶然听见这首歌觉得...

[详情]分类:曲谱大全时间:07:34 流行口琴曲谱

流行口琴曲谱 曲谱自学网今天精心准备的曲谱是《流行口琴曲谱》,下面是详解!

适合初学者的口琴简谱,要流行音乐的

我把爱铺成蓝天 ...

[详情]分类:曲谱大全时间:07:35 又见山里红曲谱

又见山里红曲谱 曲谱自学网今天精心准备的曲谱是《又见山里红曲谱》,下面是详解!

又见山里红简谱

分类:曲谱大全时间:07:31 钢琴流行曲谱

钢琴流行曲谱 曲谱自学网今天精心准备的曲谱是《钢琴流行曲谱》,下面是详解!

有没有流行歌曲的钢琴简谱

樱花草,老人与海,爱转角等。谢谢。本人急...

[详情]分类:曲谱大全时间:07:29 古筝乡韵曲谱

古筝乡韵曲谱 曲谱自学网今天精心准备的曲谱是《古筝乡韵曲谱》,下面是详解!

古筝 乡韵

乡韵多难?既然云裳诉是它改的,乡韵应该也很难吧,特长生...

[详情]分类:曲谱大全时间:07:27 初学古琴曲谱

初学古琴曲谱 曲谱自学网今天精心准备的曲谱是《初学古琴曲谱》,下面是详解!

请问初学者如何识古琴谱,对谱怎么弹?

减字谱:

[详情]分类:曲谱大全时间:07:27

识谱还是比... 一生无悔曲谱

一生无悔曲谱 曲谱自学网今天精心准备的曲谱是《一生无悔曲谱》,下面是详解!

基督教歌曲为福音一生无悔谱

基督教歌曲为福音一生无悔谱...

...[详情]分类:曲谱大全时间:07:26 手机曲谱软件

手机曲谱软件 曲谱自学网今天精心准备的曲谱是《手机曲谱软件》,下面是详解!

在手机上怎么制作谱子

没试过用手机做谱子,效率太低了…

[详情]分类:曲谱大全时间:07:22

建... 渴望主题曲谱

渴望主题曲谱 曲谱自学网今天精心准备的曲谱是《渴望主题曲谱》,下面是详解!

渴望的简谱

《渴望》的简谱是电视剧《渴望》录制的同名主题曲...

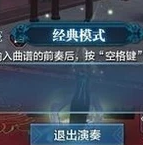

[详情]分类:曲谱大全时间:07:22 乐伶曲谱在哪

乐伶曲谱在哪 曲谱自学网今天精心准备的曲谱是《乐伶曲谱在哪》,下面是详解!

天涯明月刀ol乐伶曲谱怎么获得

首先你要学会第一职业 第二行里面...

[详情]分类:曲谱大全时间:07:21 天刀童话曲谱

天刀童话曲谱 曲谱自学网今天精心准备的曲谱是《天刀童话曲谱》,下面是详解!

天涯明月刀ol文士曲谱有哪些

笛曲·水云游 由身份技能点...

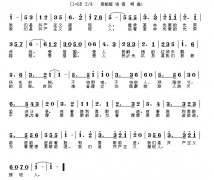

[详情]分类:曲谱大全时间:07:20 天刀曲谱弹琴

天刀曲谱弹琴 曲谱自学网今天精心准备的曲谱是《天刀曲谱弹琴》,下面是详解!

天涯明月刀乐伶怎么弹琴给别人加BUF

1:要想加BUF,首先游戏中...

[详情]分类:曲谱大全时间:07:20 天竺少女曲谱

天竺少女曲谱 曲谱自学网今天精心准备的曲谱是《天竺少女曲谱》,下面是详解!

天竺少女的古筝谱

分类:曲谱大全时间:07:18 绿岛小夜曲曲谱

绿岛小夜曲曲谱 曲谱自学网今天精心准备的曲谱是《绿岛小夜曲曲谱》,下面是详解!

绿岛小夜曲原唱晋秦歌词和谱曲

绿岛小夜曲原唱晋秦歌词和谱曲...[详情]

分类:曲谱大全时间:07:17 越剧曲谱下载

越剧曲谱下载 曲谱自学网今天精心准备的曲谱是《越剧曲谱下载》,下面是详解!

求越剧简谱

吴凤花的《狸猫换太子》拷寇部分,三次举起无情棒的曲谱,...

[详情]分类:曲谱大全时间:07:13 萨克斯曲谱简谱

萨克斯曲谱简谱 曲谱自学网今天精心准备的曲谱是《萨克斯曲谱简谱》,下面是详解!

学萨克斯要学五线谱还是简谱

学萨克斯必须学五线谱。

[详情]分类:曲谱大全时间:07:37

其实...